- Published on

The Dangers of the Corporate Transparency Act & BOI Reporting Requirements

- Authors

- Name

- Weslen T. Lakins

- @WeslenLakins

The Corporate Transparency Act (CTA) and the Beneficial Ownership Information (BOI) Reporting Requirements represent a dramatic increase in the surveillance and control powers wielded by the government over private businesses in the United States.1 As businesses, whether conventionally structured or otherwise, scramble to understand and comply with these invasive regulations, this article aims to dissect the essence of the CTA and BOI Reporting, offering critical insights into what really lies beneath these supposedly well-intentioned requirements.2

What is the Corporate Transparency Act?

Branded as a landmark piece of legislation, the Corporate Transparency Act was ostensibly created to unveil the hidden layers of ownership in business operations, specifically targeting shell companies and obscure structures often implicated in illicit activities.3 At its core, the CTA compels certain businesses to report their beneficial owners to the Financial Crimes Enforcement Network (FinCEN), ostensibly to bolster transparency and deter financial crimes.4

Enacted as a part of the broader Anti-Money Laundering Act of 2020, the CTA zeroes in on the exploitation of corporate structures for illicit ends, a problem with consequences that ripple across the globe.5 It posits that in our interconnected world, the shroud of corporate secrecy doesn't just conceal domestic misdeeds but also international threats, contributing to everything from money laundering to terrorism financing.6 The CTA, therefore, purports to tear off the veil that has long covered these illicit acts, positioning itself as a crucial weapon in the global fight against financial crime.7

However, beneath its veneer of righteousness, the CTA is more than a mere regulatory mandate; it's a symbol of an increasingly invasive ethos in the world of business regulation.8 In an age where transparency is often conflated with integrity, the CTA seems to align with a general public demand for corporate accountability and ethical behavior.9 It broadcasts a potent message that the United States is dedicated to setting a precedent, ensuring that businesses within its boundaries are not merely profitable but operate on a plane of higher moral ground.10 For businesses, this means compliance isn't merely about dodging fines; it's about conforming to these escalating standards and showcasing a commitment to ethical operation.11

Yet, what's often overlooked is the CTA's role as a harbinger of enhanced governmental oversight and a potential threat to privacy and autonomy.12 It's a nod to the complexities of modern business structures and a call for more intricate regulatory tools.13 Designed to evolve with the myriad ways in which businesses are structured and operate, from traditional brick-and-mortar establishments to digital enterprises with global footprints, the CTA is not a static set of rules but a dynamic, expanding framework.14 For attorneys and business owners, understanding the CTA is about recognizing the undercurrents of this law as much as its overt objectives, preparing for a future where transparency might well mean vulnerability, and where corporate legitimacy could be at the mercy of ever-watchful governmental eyes.15

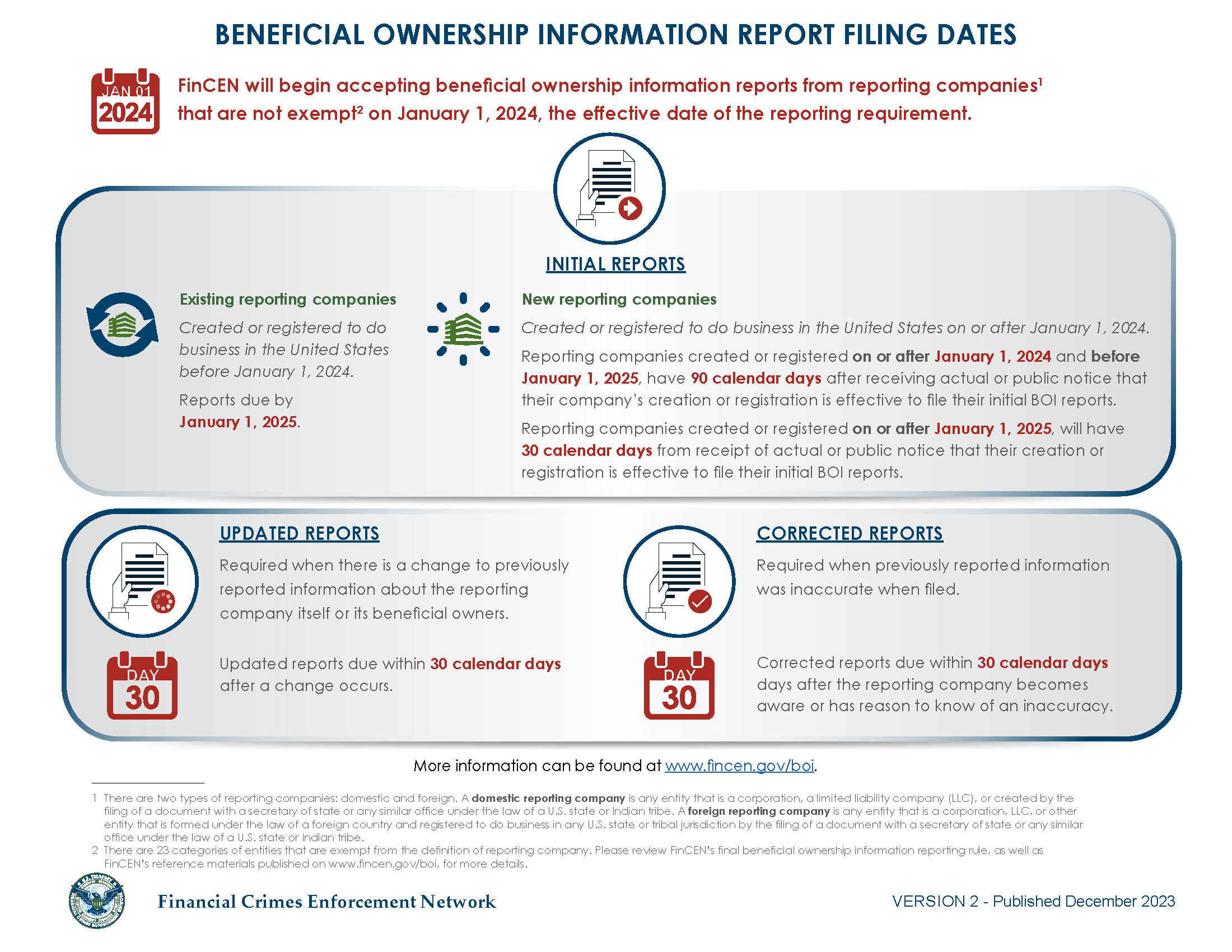

Beneficial Ownership Information Report Filing Dates16

A Cloaked Threat to Privacy

The narrative spun around Beneficial Ownership Information (BOI) Reporting under the Corporate Transparency Act (CTA) is one of a necessary measure to combat financial crimes like money laundering and terrorism financing.17 It mandates the disclosure of detailed information about the individuals who ultimately own or control a company, creating a federal registry of ownership accessible to law enforcement and certain financial institutions.18 While this might be packaged as a strategic move for greater security, it's crucial to recognize the potential invasion of privacy and autonomy it represents.19

BOI Reporting isn't simply a matter of compliance or filling out forms.20 It's a deep dive into the private affairs of businesses, an act of peeling back layers to reveal the core of a company's ownership.21 The individuals classified as "beneficial owners" – often those exerting significant influence or reaping substantial rewards from behind the scenes – are thrust into the spotlight, their once-private associations and control mechanisms laid bare for governmental scrutiny.22

This process of identifying beneficial owners is not just meticulous; it's invasive.23 It's not merely about listing names but dissecting the web of relationships and control mechanisms that define modern businesses.24 For some entities, particularly those with complex structures or international ties, it represents a significant intrusion into private business operations.25 Lawyers and business owners are compelled to unravel the intricacies of their enterprises, tracing lines of control and interest back to their source, leaving no stone unturned in a quest not just for transparency but for full exposure.26

While proponents argue that BOI Reporting bolsters business integrity and reassures investors and partners of a company's ethical standing, it's essential to question at what cost.27 This enforced transparency converts private business information into a public commodity, potentially undermining the very foundation of trust and discretion on which many business relationships are built.28 It shifts the narrative from one of mutual trust and respect to a presumption of guilt, where companies must prove their innocence through exposure.29

Moreover, the journey of BOI Reporting is not a one-time affair but a continuous, looming responsibility.30 Businesses must remain ever-vigilant, constantly updating records to reflect any changes in ownership structures.31 This ongoing requirement signifies not just a commitment to transparency but an unending concession to surveillance, a perpetual cycle of scrutiny that keeps businesses tethered to the whims of regulatory bodies.32

In its essence, Beneficial Ownership Information Reporting is not just a story of transparency and accountability; it's a tale of the delicate balance between security and privacy, a balance that seems increasingly tilted in favor of invasive oversight.33 For attorneys and business owners, it's a chapter marked by the struggle to maintain the confidentiality and autonomy of their enterprises while navigating an ever-expanding maze of regulatory demands.34

As we delve deeper into the implications of BOI Reporting, it's crucial to remember that this isn't just about complying with regulations.35 It's about understanding the broader impact on the fundamental rights to privacy and the autonomy of businesses and individuals alike.36 It's about recognizing BOI Reporting for what it truly is – not just a regulatory hurdle but a potential threat to the privacy and freedom that form the bedrock of a thriving, innovative business ecosystem.37

105 – Part II Exemptions to the Beneficial Ownership Information (BOI) Reporting Requirements: A Mirage of Privacy?

Understanding the exemptions under Part II of the BOI Reporting Requirements might seem like a beacon of hope for those wary of government overreach.38 These exemptions, covering 23 categories of entities such as publicly traded companies, large operating companies, and certain regulated entities like banks and credit unions, are often touted as a sensible balance between the need for transparency and respecting the autonomy of businesses.39 However, a closer look reveals that these exemptions might be more of a mirage, offering the illusion of privacy and autonomy while still ensnaring businesses in a web of surveillance and control.40

The exemptions under the BOI Reporting Requirements are not merely administrative clauses; they are complex legal constructs that recognize the diversity of corporate entities and their varied exposure to illicit activities.41 While they are purportedly designed to balance transparency needs with the realities of business operations, one must question whether this balance is truly achieved or if it's a skewed scale, favoring extensive governmental insight into private business matters.42

On the surface, these exemptions seem to provide a reprieve for certain entities, acknowledging that businesses like publicly traded companies or heavily regulated institutions such as banks and credit unions already operate under stringent transparency requirements.43 The rationale is that these entities, by virtue of their existing compliance burdens, pose a lower risk of being used for illicit activities and thus do not need the added layer of BOI reporting.44 This ostensibly prevents unnecessary duplication and allows resources to be concentrated where they are most needed.45

However, the journey through these exemptions is fraught with complexity and ambiguity.46 Each category comes with its own set of intricate criteria and proving eligibility can be as burdensome as the reporting itself.47 The burden of proof rests heavily on the entity seeking the exemption, requiring detailed documentation and often legal interpretation to navigate the murky waters of compliance.48 For many businesses, understanding and proving their eligibility for exemptions becomes a labyrinthine process, consuming resources and energy that could be directed towards growth and innovation.49

Moreover, these exemptions are not static; they are as fluid as the business world itself.50 As business models evolve and new types of entities emerge, the exemptions must be continually revisited and revised.51 This constant state of flux creates an environment of uncertainty for businesses, where today's safe harbor might be tomorrow's regulatory quagmire.52 Attorneys and business owners find themselves in a perpetual state of vigilance, keeping abreast of changes to ensure ongoing compliance.53

It's also crucial to recognize that these exemptions, while providing a temporary shield from federal BOI reporting, do not offer a complete escape from transparency obligations.54 Many exempt entities are still subject to a myriad of state, federal, or international reporting requirements.55 This creates a layered compliance landscape where businesses might jump through hoops to secure an exemption on one level, only to be caught in the net of another.56

In essence, the exemptions under the BOI Reporting Requirements might seem like a nod to privacy and business autonomy, but they often serve as a complex, burdensome, and sometimes illusory reprieve from an overarching trend of increased surveillance and control.57 For businesses navigating this landscape, the exemptions are not just about understanding and complying with the law; they are about recognizing the broader implications for privacy, autonomy, and the very nature of freedom in commerce.58 As we delve deeper into the world of BOI Reporting, it's imperative to see these exemptions for what they truly are: not just a regulatory nuance but a reflection of the ongoing tension between privacy and security in the modern business ecosystem.59

Case Study: Legitimate Ways a Business Entity Might be Structured to Exempt a Beneficial Owner of an LLC from Reporting Requirements

In the shadow of the Corporate Transparency Act (CTA) and Beneficial Ownership Information (BOI) Reporting Requirements, businesses are often caught in a paradoxical struggle: maintaining privacy while adhering to an ever-tightening web of regulations.60 While some entities may find legitimate pathways to structure themselves into exemption from reporting obligations, the journey is akin to navigating a labyrinth, fraught with legal and ethical considerations.61

It's important to remember that while some entities may be structured in ways that exempt them from reporting obligations under the Corporate Transparency Act (CTA) and Beneficial Ownership Information (BOI) Reporting Requirements, these structures should always be legally sound and comply with all applicable laws and regulations.62 Any attempt to evade reporting requirements through deceptive or fraudulent means could lead to significant legal and financial consequences.63 That said, here are some legitimate ways a business entity might be structured to potentially exempt a beneficial owner of an LLC from reporting obligations:64

- Qualifying for Exemptions: Structure the LLC so that it falls under one of the 23 exemptions provided in the CTA.65 For example, if the LLC is a subsidiary of a publicly traded company, it might qualify for an exemption as these companies are typically subject to rigorous public disclosure requirements.66

- Operating as a Large Operating Company: Structure the entity as a large operating company that meets the specific criteria set forth in the exemptions.67 This might include having a significant physical presence, a substantial number of full-time employees, and a large operating revenue.68

- Becoming a Regulated Entity: Convert or structure the LLC into an entity type that is heavily regulated and already subject to substantial federal or state oversight, such as a bank, credit union, or insurance company, which are typically exempt from additional BOI reporting.69

- Collaborating with Governmental Entities: If the LLC is created under the laws of the United States, a State, Indian Tribe, or political subdivision and exercises governmental authority on behalf of any of these, it might qualify for an exemption as a governmental authority.70

- Inactive Entity Status: If the LLC qualifies and maintains a status as an inactive entity as defined under the CTA, it might be exempt from reporting.71 This usually means the entity has been dormant for a certain period, with no assets or business operations.72

- Utilizing Trust Structures: In some cases, using a trust with specific characteristics as the owner of the LLC might change the reporting obligations.73 However, this is complex and heavily dependent on how the trust is structured and the specific roles of trustees and beneficiaries.74 Legal advice is essential here.75

- Foreign Entity Considerations: If the LLC is a foreign entity and does not conduct business in the U.S. or is otherwise exempt, it might not have reporting obligations.76 However, this is a nuanced area and requires careful legal and regulatory examination.77

- Venture Capital Exemptions: If the LLC operates as a venture capital fund advisor and meets specific criteria, it might be exempt from reporting requirements.78

- Industry-Specific Structures: Some exemptions are tailored to specific industries, such as pooled investment vehicles or insurance companies.79 Structuring the LLC to legitimately operate within these sectors might provide an exemption.80

- Maintaining Minority Ownership: Ensure no single beneficial owner meets the threshold that triggers reporting requirements (typically 25% ownership or significant control).81 However, this must be a genuine arrangement and not a facade to evade reporting.82

In all cases, it's crucial to consult with legal professionals to ensure that the structure not only provides exemption from reporting where legitimately applicable but also complies with all other legal and regulatory requirements.83 Any approach to structuring an entity to minimize or eliminate reporting obligations should be pursued with caution and adherence to the law.84

Navigating New Reporting Requirements

For attorneys and business owners, navigating the new reporting requirements imposed by the Corporate Transparency Act (CTA) and Beneficial Ownership Information (BOI) Reporting Requirements is akin to a trek through a wilderness of surveillance.85 These mandates, ostensibly aimed at enhancing transparency, compel a meticulous dissection of corporate structures and ownership, akin to an invasive probe into the private affairs of businesses.86 This journey isn't just about compliance; it's about confronting an era where Big Brother's gaze is becoming increasingly pervasive and penetrating.87

The initial hurdle is the daunting depth of information required.88 Far from a simple registry of names, the CTA demands a granular exposition of each beneficial owner's identity, complete with verified personal details.89 This isn't just data collection; it's a forensic inquiry into the personal realms of individuals, demanding a level of scrutiny that borders on the intrusive.90 Such a process necessitates a precision and rigor that goes beyond standard business practice, reflecting the intense seriousness with which the government now intrudes into the corporate domain.91

Yet, the complexity of these requirements isn't merely procedural but deeply conceptual.92 Defining a 'beneficial owner' is an exercise in decoding a web of relationships and control mechanisms, especially for entities with complex, layered ownership or those operating across multiple jurisdictions.93 Here, legal expertise isn't just helpful; it's critical, providing the necessary acumen to navigate these murky waters and interpret the criteria within the unique context of each entity.94

Beyond the technicalities, the CTA mandates a proactive, almost prescient approach to compliance.95 It's insufficient to merely understand the current structure and ownership; businesses must anticipate and adapt to future shifts.96 The landscape of ownership is not static but dynamic, and with every evolution comes a new set of reporting obligations.97 This requirement for constant vigilance and adaptability underscores the pervasive nature of these regulations, reflecting a new norm where businesses are perpetually tethered to the regulatory eye.98

Moreover, these reporting requirements signal a cultural shift, heralding an age where transparency is not just a regulatory demand but a value embedded into the very ethos of a business.99 Embracing this culture of openness might appear to offer a strategic advantage, positioning the entity as a paragon of trustworthiness.100 However, it also represents a forced relinquishment of privacy, a concession to a world where every detail is potentially subject to government scrutiny.101

For smaller entities or those with limited resources, these requirements present formidable challenges.102 The path to compliance, fraught with potential missteps and penalties, can seem like a maze, where one wrong turn could lead to significant legal and reputational repercussions.103 Here, the role of collaboration and support networks becomes not just beneficial but essential.104 Industry associations, professional networks, and legal advisors emerge as critical allies in demystifying the process and making compliance achievable.105

Technology, too, plays a critical role in navigating this new landscape.106 Robust systems for data collection, storage, and reporting are not just tools for compliance; they're shields against the risks of inadvertent errors or omissions.107 Yet, even as businesses invest in these technologies, they must recognize that they are also enabling deeper levels of surveillance, further entrenching the culture of monitoring and control.108

As businesses embark on this journey, the horizon holds both opportunities and threats.109 The regulatory landscape is not static but ever-evolving, with each change bringing new challenges and complexities.110 Staying informed and adaptable is crucial, but so is a critical understanding of the broader implications.111 Each step towards compliance is also a step into a world where privacy is increasingly sacrificed at the altar of transparency, and where Big Brother's new toy, the CTA, becomes an ever-more-potent instrument in the surveillance arsenal.112 In navigating these new reporting requirements, businesses must tread carefully, balancing the demands of compliance with the imperative to protect the sanctity of privacy and autonomy in an age of ever-escalating surveillance.113

The Struggle Between Privacy and Security

On one side of the battlefield, proponents of the Corporate Transparency Act (CTA) champion the legislation as a critical shield against the dark underbelly of international crime.114 They argue that stripping away the layers of corporate anonymity is not just beneficial but essential for national security.115 By illuminating the shadowy figures behind companies, the CTA ostensibly acts as a beacon, deterring the illicit activities that fund terrorism, money laundering, and other societal menaces.116 This perspective is rooted in the belief that security, a collective good, may at times necessitate the sacrifice of individual rights for the greater welfare.117

Conversely, critics of the CTA sound the alarm on the potential for an Orwellian future.118 They argue that the act of compelling businesses to unveil detailed owner information is a direct assault on the right to confidentiality, a move that inches us closer to a 'surveillance state'.119 This isn't just about shielding the wealthy or corporate titans; it's about resisting a precedent that could erode privacy for all, from towering conglomerates to the small corner store and every individual in between.120

The struggle between privacy and security isn't a hypothetical debate confined to academic circles; it has tangible, far-reaching implications.121 Every business owner, investor, and, by extension, every citizen, finds themselves at the nexus of this conflict.122 The central question we grapple with is profound yet unsettling: Where do we draw the line?123 How much privacy are we willing to forgo in the quest for security?124 And perhaps most critically, who gets to decide?125

The answers are far from black and white.126 They demand a nuanced, informed understanding of the risks and benefits, a delicate weighing of the chilling effects on privacy and innovation against the potential for thwarting devastating criminal enterprises.127 It's a balancing act of monumental proportions, and the consequences of tipping the scales in the wrong direction could be irrevocable.128

As we tread this intricate terrain, we must critically evaluate whether the CTA and BOI reporting requirements strike an equitable balance or whether they represent an overreach, a pendulum swung too far into the realm of intrusion.129 We're compelled to consider not just the present landscape but the legacy we're crafting for future generations.130 The struggle between privacy and security isn't a novel phenomenon, but regulations like the CTA thrust it under a glaring spotlight, demanding that we confront these dilemmas head-on.131

In the grander scheme, the discourse surrounding privacy versus security transcends mere laws and regulations; it's fundamentally about the kind of society we aspire to inhabit.132 It's a quest for a path that harmoniously respects our need for privacy and our imperative for protection.133 As this debate unfolds, let us navigate with wisdom and foresight, for the choices we make today will invariably sculpt the contours of our collective future.134

Final Thoughts: A Call for Deliberation and Wisdom

The Corporate Transparency Act and the Beneficial Ownership Information Reporting requirements signify a profound shift toward transparency and accountability in the business world.135 For attorneys and business owners, understanding and navigating these regulations is a complex dance of legal compliance and ethical consideration.136 It's about contributing to the global fight against financial crimes while vigilantly safeguarding the sanctity of privacy and autonomy.137

As we adapt to these new mandates, it's imperative to remember that they signify more than a regulatory shift; they represent a pivotal moment in the ongoing tussle between privacy and security.138 These regulations are a step towards a more transparent and ostensibly secure business environment, but at what cost?139 As we chart this course, let us proceed with caution and deliberation, ever mindful of the delicate balance we must maintain.140 Our actions and decisions in this era will set precedents and forge paths for the future.141 In navigating these waters, let our guiding stars be wisdom, foresight, and a steadfast commitment to preserving the fundamental liberties that define us.142

Footnotes

See Corporate Transparency Act, 31 U.S.C. §§ 5331, 5336 (2020). ↩

See id. ↩

See Anti-Money Laundering Act of 2020, Pub. L. No. 116-283, §§ 6001-6511, 134 Stat. 3388 (2020). ↩

See 31 U.S.C. § 5336. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See Financial Crimes Enforcement Network, Fact Sheet: Beneficial Ownership Information Reporting (2021). ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See 31 U.S.C. § 5336. ↩

See id. ↩

See id. ↩

See id. ↩

See Financial Crimes Enforcement Network, Fact Sheet: Beneficial Ownership Information Reporting (2021). ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See Financial Crimes Enforcement Network, Fact Sheet: Beneficial Ownership Information Reporting (2021). ↩

See id. ↩

See id. ↩

See id. ↩

See 31 U.S.C. § 5336. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See Financial Crimes Enforcement Network, Fact Sheet: Beneficial Ownership Information Reporting (2021). ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See 31 U.S.C. § 5336. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See Financial Crimes Enforcement Network, Fact Sheet: Beneficial Ownership Information Reporting (2021). ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See 31 U.S.C. § 5336. ↩

See id. ↩

See Financial Crimes Enforcement Network, Fact Sheet: Beneficial Ownership Information Reporting (2021). ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See Financial Crimes Enforcement Network, Fact Sheet: Beneficial Ownership Information Reporting (2021). ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩

See id. ↩